Business Model, Strategy & Markets

DSW offers a timely challenger model in a changing market

Business model

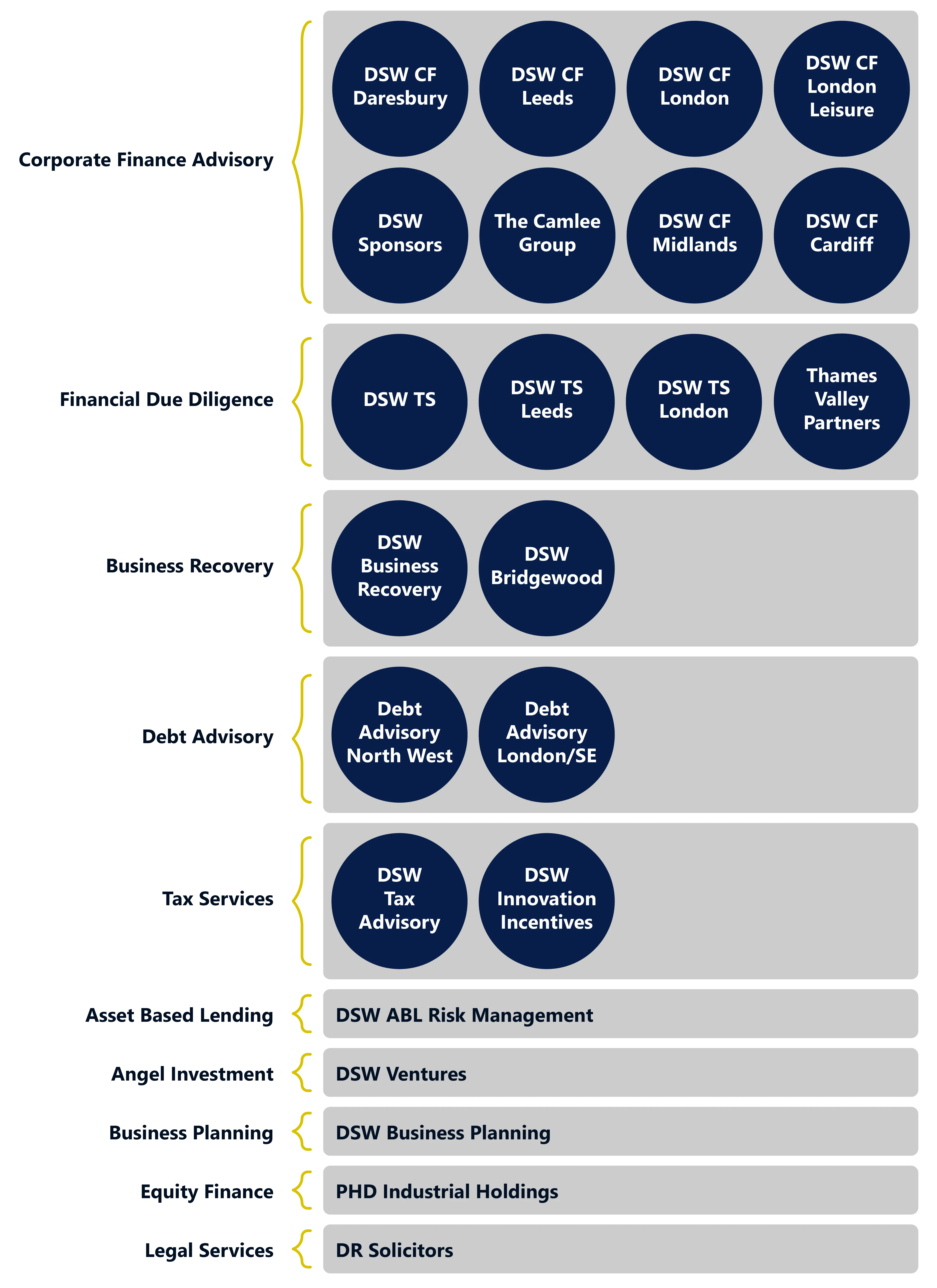

As of 31 July 2025, DSW operates licensing arrangements with its licensee businesses and has over 130 fee earners across 12 offices in the UK. These businesses trade primarily under the Dow Schofield Watts and DR Solicitors brands.

First conceived in 2008, the licence model established by DSW Capital allows ambitious professionals to use the DSW and DR Solicitors brands and access its network. DSW Capital provides start-up funding and can take care of many aspects associated with the running of the “office”, which includes IT, compliance guidance, accounting, marketing, recruitment, people development support and banking. This model enables teams to hit the ground running and focus on growing their respective businesses, maximising their profit capabilities and building a legacy. In return, DSW Capital receives a percentage of the licensee’s revenue and, in some cases, a percentage of the licensee’s profits.

Consultant model

DR Solicitors is one of the first businesses to develop a consultant based operating model and embrace alternative business structures. DR Solicitors operates an alternative fee sharing model in which they engage and win clients directly and subcontract the work to consultants. Consultant professionals are empowered to deliver quality legal work and retain a percentage of revenue generated.

The platform businesses that comprise Dow Schofield Watts

Growth strategy

DSW aims to scale its agile model through organic growth, strategic collaborations, and the acquisition of businesses with a focus on high margin, complementary, niche service lines with a strong synergistic fit with the existing DSW Network.

The key growth drivers are:

- Organic growth in fee earners in existing licensees

- Recruitment of new licensees

- Acquisition of licence fees

- Strategic collaborations

- Acquisitions

The financial, professional and business services sector

The UK is a global hub for activity in the Professional and Business Services sector, being one of the largest and most developed markets internationally. This is due to the existence of a well-developed eco-system of complementary professional services. Consequently, the sector is an important contributor to the UK economy, both in terms of value added to other businesses and sectors, and its own contribution to GDP.

Despite macroeconomic headwinds—including persistent inflation, interest rate uncertainty, and geopolitical tensions, confidence within the sector remained high. Additionally, the regulatory complexity and economic uncertainty have driven increased demand for high-quality advisory services, particularly in corporate finance and restructuring.

The legal & primary care sectors

The legal sector is evolving, with the rise of platform firms offering flexible, consultant-led models that challenge traditional law firm structures. Platform firms are gaining traction by offering lawyers greater autonomy, supported by centralised business services and a focus on niche specialisms.

The UK healthcare landscape continues to evolve amid significant government investment and reform, including the largest uplift in GP funding in years. Primary care is the cornerstone of the UK’s National Health Service (NHS), providing the first point of contact for patients. It includes services delivered by general practitioners (GPs), community pharmacists, dentists, and optometrists. Over the past decade, the sector has undergone significant transformation, particularly with the introduction of PCNs in 2019. These networks aim to foster collaboration among GP practices and other healthcare providers to deliver more integrated, community-based care.

Market dynamics

One of the most notable trends is the growing demand for high-quality advisory services outside of London and the traditional dominance of the Big Four. DSW’s commitment to the UK regions, and the underserved mid-market, positions the Group to capitalise on this shift. Clients are increasingly seeking personalised, partner-led services from professionals who understand their local markets—something our Network is uniquely structured to deliver.

The influence of private equity in the professional services sector is also reshaping the landscape. While PE investment has driven growth in some firms, it has also introduced rigid structures and performance pressures that can limit flexibility and autonomy. This has created a “push factor” for experienced professionals seeking greater control over their careers— an opportunity that DSW and DR Solicitors are well-placed to capture through our agile model, empowering the next generation of pioneers in the sector.

In the legal sector, the Directors are seeing a growing trend of lawyers transitioning into consultancy roles. This reflects a broader shift toward more entrepreneurial career paths and a desire for greater work-life balance. DR Solicitors’ specialist focus and flexible structure make it an attractive platform for legal professionals looking to operate with independence while benefiting from the support of a well-established brand.