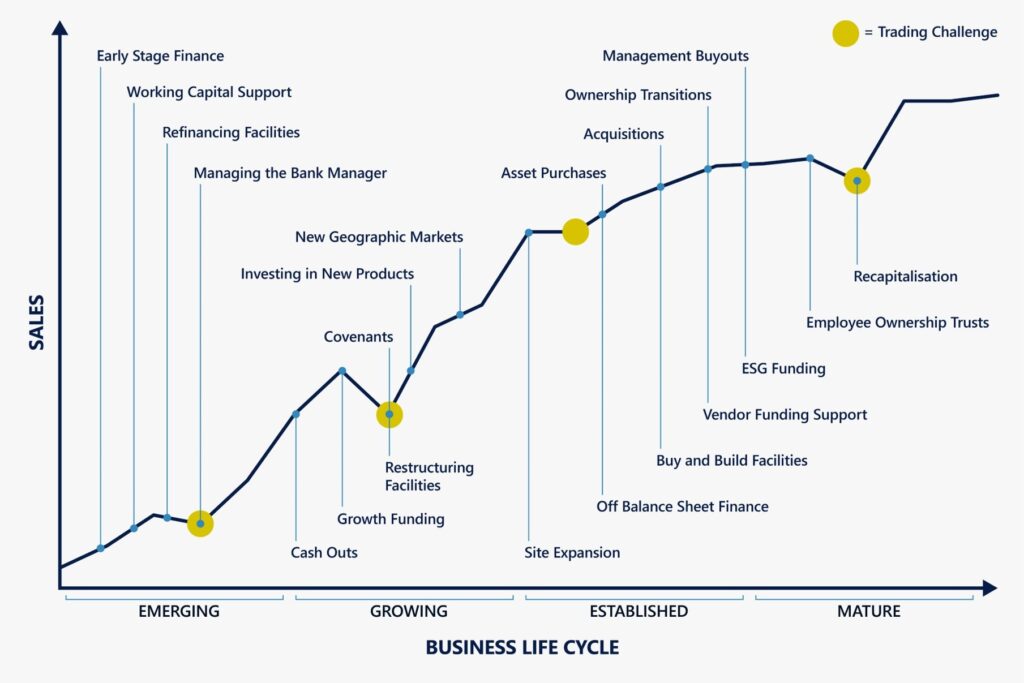

When Should I Involve a Corporate Debt Advisor?

There are numerous events within a business’s lifecycle that may benefit from or require debt financing. The structuring of senior debt facilities can be complex and time-consuming; specialist debt advice from experienced funders will almost always save you time and money.

Involving an adviser early on will maximise your chances of obtaining a competitively priced package of facilities ideally suited to your needs.

Some examples of events where advice from an expert should be sought are:

Early stage finance or working capital support

Revenues are growing, but working capital facilities are needed to fund the ongoing growth (e.g., as a result of new contracts or customer wins).

Growth funding

An established and profitable business looking to invest in accelerating its growth (e.g., in new products, geographic markets, or operational capabilities).

Financing of business assets

Off-balance-sheet leasing or purchase of business assets (e.g., plant and machinery) or use of asset-backed lending (eg against stock and receivables).

Property financing

The development of, investment in, purchase or sale, and leaseback of real estate assets.

Business acquisitions

Inorganic expansion of the business to drive a step change in scale and/or capabilities.

Ownership transitions or vendor funding support

The sale and purchase of the business by management, an employee-owned trust, or another corporate entity (e.g., the pre-arrangement of a comprehensive debt package facility for purchasers can speed up/retain control of the sale process and maximise the sale price).

Refinancing of existing facilities

Sudden economic changes can affect a funder’s appetite for and pricing of new facilities in different sectors; 6 months is the recommended minimum planning and implementation timeframe ahead of the maturity of existing funding lines.

Restructuring facilities and covenants or managing the Bank Manager

Challenging market conditions and underperformance against budgets can make existing facilities highly onerous and subject to restrictive bank requirements. Careful management of all funder communications is critical to any successful amendment and extension of facilities and relaxation of financial covenants.

Specialist funding

Complex, unusual, or niche situations require highly specialised funding solutions such as asset-based lending, mezzanine loans, venture debt, subordinated loans, or payment-in-kind instruments.

Get in touch

Starting a conversation with us is easy. Let us know a little about the advice you need, and we’ll put you in the hands of the right expert. No pressure to sign up for services, just a friendly chat.