A new landscape for R&D tax relief

The landscape for Research & Development (R&D) tax relief has entered a new phase following a series of reforms designed to streamline the system and enhance compliance, as Shenal Wijetunge outlines.

The new measures have been introduced over two successive years – 2023 and 2024 – and have coincided with much greater scrutiny by HMRC, with many businesses being asked to supply further evidence to support their claims.

The new regime is likely to be in place for the foreseeable future, regardless of any political changes, so it is important that businesses get to grips with it. The message is clear for those engaged in qualifying R&D activities: there is no need to shy away from making a claim, provided it is done correctly and compliantly. Here, we look more closely at the changes and what companies must do now.

The changes in brief

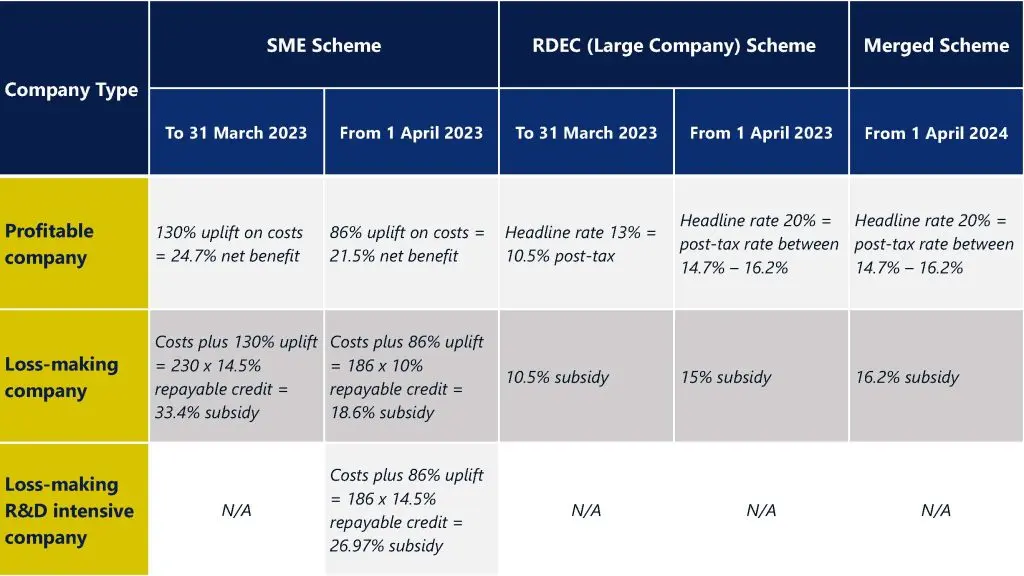

A key point of the reforms was that from 1 April 2023, the additional deduction for SMEs was reduced from 130% to 86%, while for large companies (under the RDEC scheme), the credit was increased from 13% to 20%. However, as of 1 April 2024, both schemes have been merged, so all companies can now claim at the 20% rate regardless of their size.

See chart for full details of the rates.

The amount of relief SMEs can claim has also been capped, though the list of qualifying expenditures has been extended to include cloud computing and datasets. In most cases, claims must now be submitted digitally, and companies must submit detailed additional information. A pre-notification process is designed to enhance transparency and accountability while providing certainty for businesses engaged in genuine R&D activities.

What do companies need to do now?

The reforms place a strong emphasis on compliance and the integrity of claims. HMRC has intensified its scrutiny to reduce fraudulent claims, leading to more businesses receiving detailed requests for information and evidence supporting their claims. However, there are growing concerns that genuine R&D claims are being rejected, highlighting the need for clearer internal guidance and an improved processing framework.

Being well-prepared can mitigate the risks associated with HMRC enquiries. The reforms reinforce the need for diligent preparation backed by expert advice to navigate the evolving landscape. Here are five ways businesses can help ensure that claims are processed smoothly without delays or rejections:

- Maintain comprehensive documentation – ensure all R&D activities, expenditures, and related justifications are well-documented.

- Seek expert advice – Consider consulting with R&D tax specialists to ensure claims are robust and compliant with the latest HMRC guidelines.

- Regularly review claims processes – Continuously assess and update your claiming processes to align with current regulations and best practices.

- Ensure claims are accurate – even if you are using specialist advisors, businesses are ultimately accountable for the validity of their claims and any resultant liabilities or penalties.

- Prepare for digital submissions – Adapt to new requirements for digital submission of claims and pre-notification processes to streamline and validate claims effectively.

The new era represents continuity rather than disruption for businesses that have consistently adopted a thorough and compliant approach to their R&D tax relief claims. They should view these changes as an opportunity to reassess and strengthen their claiming processes, ensuring adherence to the new requirements while optimising their relief.

Get in touch

Dow Schofield Watts’ Tax Advisory team is here to guide you through these changes, ensuring your R&D claims are compliant and helping protect your business from HMRC enquiries. Our services include preventative strategies and solutions for addressing any issues.

Please contact us below with any queries you have about receiving R&D tax relief.